Two major Bitcoin entities are reportedly stockpiling BTC at the moment despite uncertain market conditions.

According to Ki Young Ju, the CEO of analytics company Crypto Quant, who has 308,400 followers on Twitter, wealthy investors are aggressively stockpiling bitcoin through renowned digital asset exchange Binance.

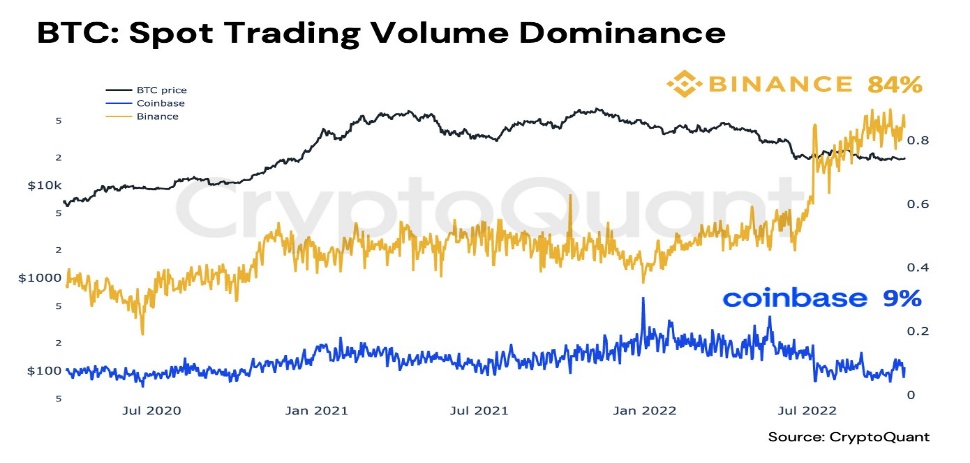

He added that “Binance now controls 84% of all spot trading volume since Bitcoin’s price crossed the $20,000 mark. Coinbase, with 9%, is the second-largest. I’m unsure if these whales are currently crypto OGs (original gangsters) or institutions employing prime brokers.”

Ki Young Ju further noted that the volume of spot trading in bitcoin has grown significantly over the last six months on all exchanges, indicating that there is enough demand to resist the intense selling pressure.

The benchmark virtual currency has decreased by almost 60% this year. Despite this year’s big sell-off in the digital currency, Ark Investment Management analyst Yassine Elmandjra stands by his company’s forecast that Bitcoin’s price will soar over the million-dollar level.

The chief investment officer of Ark, Cathie Wood, predicted earlier this year that the largest cryptocurrency in the world would reach a price of $1 million per coin by 2030.

However, as the Federal Reserve continues to aggressively tighten monetary policy, scaring investors away from riskier asset classes like cryptocurrencies, coin holders and miners have been selling off the token in large quantities in 2022.

The daily closed price barely changed last month despite volume hitting a record high for the year, suggesting that someone is buying up all of the sell-side liquidity.

Investors in the cryptocurrency market are waiting impatiently for the US Federal Reserve to raise interest rates next, which is predicted to be by 75 basis points in two weeks. Investors can examine housing starts and durable goods orders in the middle of the week.

The leading cryptocurrency has seen a significant decline from its record high, although its hash rate is still high.

Due to this, Bitcoin’s discount in relation to its hash rate reached its greatest level in October since the first quarter of 2020. Before this, there had been a significant markdown, which was followed by a big surge that lasted until 2021. Experts anticipate it might happen again this time, and Bitcoin might surpass most other important assets.

Nairametrics